Amnis offers the best free business account in Switzerland!

In today's globalized economy, international payments are a crucial factor for many SMEs and startups. However, managing multiple currencies can be complicated and expensive - especially for traditional banks. This is where Amnis Treasury comes into play. As a modern multi-currency account, Amnis offers a cost-effective and user-friendly solution that is ideal for any business of any legal form. But why is Amnis the best free business account in Switzerland?

We use Amnis ourselves for our daily payment transactions and have summarized the most important reasons for this.

First of all: If you open a free business account using our code, you will receive a credit of CHF 200 after your first FX transaction (currency exchange, e.g. CHF to EUR). credit of CHF 200 will be paid out to your Amnis account.

1. true multi-currency functionality

Amnis Treasury supports more than 20 currencies, including the most common ones such as CHF, EUR, USD, GBP. Companies can hold, receive and transfer funds in these currencies without having to exchange them immediately. This means more flexibility when it comes to making or receiving payments in the original currency. In addition, Amnis is the only neo-bank to offer a local CH account link in your name.

- Advantage: Local Swiss CHF IBAN and no unnecessary exchange costs for deposits and withdrawals.

2. extremely favorable exchange rates

Compared to traditional banks, which often add high margins on exchange rates, Amnis offers the real mid-market exchange rate with a low margin of only 0.1-0.4%.

- Example: A transfer of CHF 10,000 in EUR often costs 2-4% in fees with traditional banks. With Amnis, there are only minimal fees, which means huge savings for large volumes.

- Advantage: Transparent and predictable - no hidden fees or unfavorable exchange rates.

3. no account management fees

Amnis Treasury does not charge any monthly fees for using the account. Unlike traditional banks or many neobanks, Amnis has no account management fees, which makes it particularly attractive for sole traders and companies that want to keep their fixed costs low or are just starting out.

- Advantage: Free use with no hidden costs.

4. attractive cashback on credit balances

Amnis Treasury rewards its customers with cashback on balances, which is particularly interesting for companies that regularly hold large amounts in foreign currencies. For example, the cashback is 1.33% on EUR balances and 1.78% on USD balances.

- Advantage: Your credit works for you and generates additional income.

5. easy access and operation

Amnis' user-friendly web platform has been specially developed for companies. Functions such as currency management, transfer planning and access to real-time exchange rates are clear and easy to understand.

- Advantage: No complicated banking software or time-consuming training required.

6. specialized in international payments

Amnis is designed to make international payments as simple as possible. Companies can process their payments via the SWIFT network, making global transfers reliable and fast.

- Advantage: Ideal for companies with suppliers, customers or partners abroad.

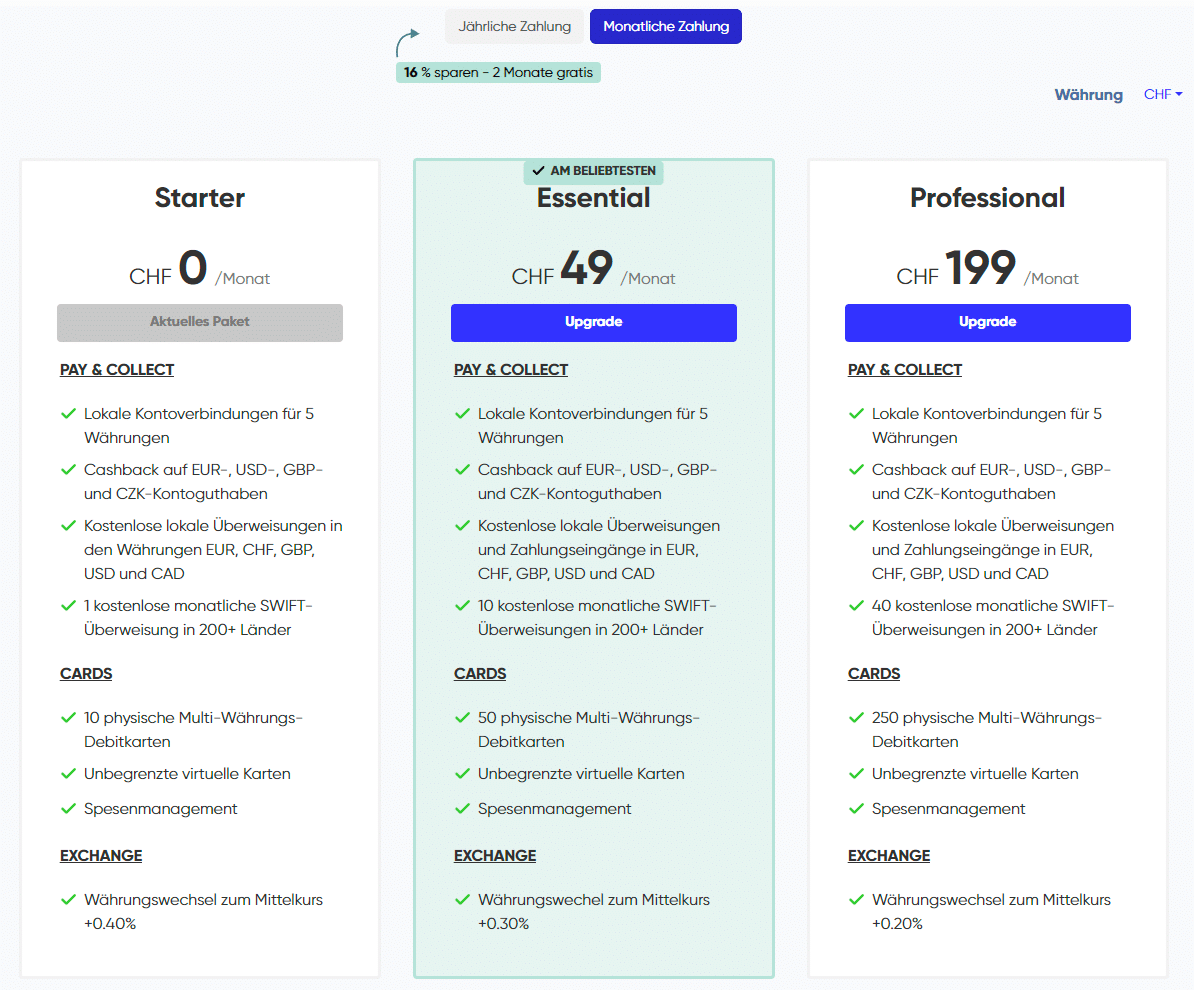

7. transparent pricing

One of the biggest problems with traditional banks is opaque pricing structures that make it difficult to calculate the actual costs. Amnis, on the other hand, offers a completely transparent pricing structure.

- Advantage: Clarity and planning security for your company.

8. no unnecessary paperwork

Opening an account with Amnis is completely digital and simple. No need to go to the branch, no long waiting times - companies can open and use their account in just a few minutes.

- Advantage: Saves time and simplifies access to professional financial solutions.

Conclusion: The best free business account in Switzerland

Amnis Treasury 's multi-currency account is the ideal choice for companies looking for an efficient and cost-effective business account. For sole proprietorships and partnerships, it can even be used as a single free account. Corporations benefit particularly when they use Amnis as a supplement for international transactions.

With real exchange rates, cashback on balances, free account management and a user-friendly platform, Amnis Treasury sets a new standard!

Do not hesitate! Receive a credit of CHF 200 after your first FX transaction (currency exchange, e.g. CHF to EUR) when you enter our code "b94e39" when opening your free Amnis account.

Details

- Account typeNeobank

- Company typeSMEs, start-ups, self-employed, international companies

- Currency20+ currencies

- Requirements: Companies worldwide

- Interest rateInterest cashback on credit balances, amount depending on currency (e.g. 1.33% on EUR and 1.78% on USD)

- Debit interest rate and loansNone

- WithdrawalsNo restrictions

- Credit cards: Free virtual cards, physical cards on request

- Capital contributionNot available

- Account management costsDepending on the plan (free of charge up to CHF 199/month)

- Payment transaction costsNo to low costs, depending on the currency

- Costs for purchasesDebit card free of charge, no foreign currency fees

- Cash withdrawal costsFree of charge

- Special servicesMulti-currency management, expense management, budget planning, currency exchange self-service

- SoftwareWeb platform, mobile app

- Exchange rate: Average exchange rate with 0.1-0.4% margin

- Local bank accountsYes (CHF, EUR, USD, GBP, CAD)